WHAT IS A TAX DEFERRED EXCHANGE?

An Internal Revenue Code Section 1031 tax deferred exchange is an IRS sanction method of characterizing the manner, (i.e. a ‘trade/exchange’ rather than a sale/purchase), a qualifying asset,(see ‘Like Kind’), may be deposed/sold without the payment of some or all of the capital gain taxes that otherwise would be due. Another way of describing a tax deferred exchange is to say: a tax deferred exchange is a ‘legally sanctioned fiction or fairy tale’. Fanciful language is used to help the reader more easily grasp an understanding of what a tax deferred exchange is and what it is not.If the IRS concludes that 2+2=5 rather than 4, then the answer for purposes of the IRS is 5. Similarly, if the IRS decides, for reasons not fully developed here, to characterize a transaction as an ‘exchange’ rather than a sale as might the general public then since it’s the IRS’s football –it’s the IRS rules and the transaction is an exchange not a sale. Again, 2 + 2 = whatever the IRS says it is.

HOW DOES ONE BENEFIT BY DOING A TAX DEFERRED EXCHANGE?

Simple. As a result of using Section 1031, the taxpayer avoids paying federal and in most instances state capital gain taxes, perhaps the 3.8% Medicare Contribution Tax, Section 1411, (Obama care), AND avoids the recapture of deprecation. The taxpayer gets to reinvest all of the property’s net equity, those sale proceeds remaining after paying all transactional expenses and any outstanding loans, to acquire one or more new properties. Presumably the new property(ies) will provide the taxpayer with a stream of income and/or use that is superior the old property(ies). Since capital is so hard to accumulate, it often is beneficial to defer paying capital gain taxes by reinvesting in a new property(ies) and continue to build wealth for you and for your family.

WHEN SHOULD A TAXPAYER ENGAGE IN A TAX DEFERRED EXCHANGE?

We believe the decision whether to engage in a tax deferred exchange by using Section 1031 is simple. We suggest the following train of thought: (1) If a taxpayer has made the business decision to sell real their property, and (2) the taxpayer has also made the business decision to reinvest a one or more new properties, and (3) a ‘sale’ of the old property will result in at least $10,000.00 in capital gain taxes then we think that it usually would be in the taxpayer’s interest to structure the transaction as a tax deferred exchange. At the very least, we believe that the taxpayer should become familiar with the elements of a tax deferred exchange. However, taxes alone should never be the sole basis for acquiring a new property(ies). It just doesn’t make much sense to acquire a new property merely to avoid paying any capital gain taxes. Exercising sound business judgment should guides one’s actions.

WHAT IS THE RATE OF FEDERAL CAPITAL GAIN TAXES?

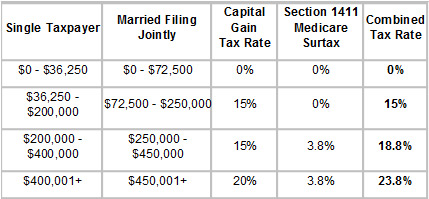

Capital gains rates are designed to encourage long-term investing. Most people can get a significant advantage from holding stock investments for more than one year:

ARE THERE OTHER TAXES WHICH MAY BE DUE IN ADDITION TO CAPITAL GAINS?

YES!! Depreciation Recapture:

First, taxpayers will be taxed at a rate of 25% on all depreciation recapture.

Net Investment Income Tax Pursuant to IRC Section 1411 (Obama Care)

When applicable, an additional 3.8% surtax applies to taxpayers with “net investment income” who exceed threshold income amounts of $200,000 for single filers and $250,000 for married couples filing jointly. Pursuant to IRC Section 1411, “net investment income” includes interest, dividends, capital gains, retirement income and income from partnerships (as well as other forms of “unearned income”).

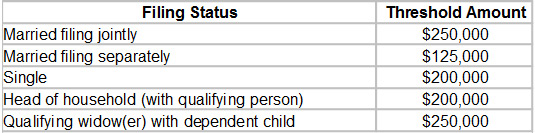

The ‘Net Investment Income’ tax includes capital gains from the sale of investment and rentals properties that is properties which have been held in a passive capacity. This tax will therefore apply to 1031 transactions held by individuals, partnerships, and sub-chapter S corporation.Individuals will owe the tax if they have Net Investment Income and also have modified adjusted gross income over the following thresholds:

State Capital Gains Taxes: Last, taxpayers must also take into account the applicable state tax, if any, to determine their total taxes owed.

Despite high overall taxes owed when combining these four levels of taxation at the disposition of an investment property, one aspect of the tax code provides real estate investors with a huge tax advantage. Section 1031 allows property owners holding property for investment purposes to defer taxes that would otherwise be recognized upon the sale of investment property. Savvy investors use 1031 exchanges to deploy their investment capital into better performing investment properties.

The ‘Net Investment Income’ tax includes capital gains from the sale of investment and rentals properties that is properties which have been held in a passive capacity. This tax will therefore apply to 1031 transactions held by individuals, partnerships, and sub-chapter S corporation.

CAN I KEEP SOME CASH AND STILL DO A TAX DEFERRED EXCHANGE?

Yes. However, you will trigger payment of capital gain tax and recapture of depreciation if you choose to keep cash. As your Qualified Intermediary, we inform the escrow agent how much money you want to keep and then escrow agent will deliver that amount to you. The balance of the funds will then be deliver to us to hold for you to use to complete your tax deferred exchange.

IS THERE A WAY I CAN GET SOME CASH AND NOT PAY TAX?

Yes. Rather than receiving the amount of money you want directly from the escrow agent who is handling your sale transaction, for which you will be taxed; instead, you reinvest all of the funds acquiring a replacement property(ies), then once the replacement property(ies) has closed, you immediately refinance the newly acquired property and received the amount of money you want in the form of a loan. Loan proceeds are not taxable because the amount must be repaid. You will need to carefully compare what amount you would pay in taxes by taking the funds directly with any costs you may incur by using a loan to obtain the funds.

HOW DOES A TAX DEFERRED EXCHANGES DIFFER FROM A SALE?

The primary difference between these two types of transactions is the different types of consideration or payment that the owner receives from the party that is acquiring the subject property. A ‘sale’ is very simple. The owner/seller usually receives consideration in the form of cash. The IRS has determined that cash is not ‘like kind’ to the property is being sold and the other party, that is the buyer, receives the property as his consideration. A common sale transaction occurs when Taxpayer A sells Whiteacre to Taxpayer B for $100,000.A tax deferred exchange is different because when Taxpayer A disposes of Whiteacre to Taxpayer B, as noted above, but rather than Taxpayer A receiving cash, Taxpayer A instead receives in trade a new property – Blackacre. Blackacre is considered by the IRS to be ‘like kind’ to Whiteacre and thus qualifies as a tax deferred exchange.A Qualified Intermediary is not involved in a sale transaction but a Qualified Intermediary is involved in completing a tax deferred exchange. This is an exchange differs because the taxpayer will receive consideration that the IRS has determined to be ‘like-kind’.

HOW IMPORTANT IS IT THAT THE PROPERTIES TO BE EXCHANGED ARE ‘LIKE-KIND’ TO EACH OTHER?

Pursuant to IRC Section 1031 (a)(1) it is essential that all of the properties which are to be the subject of a IRC Section 1031 tax deferred exchange are ‘like-kind’ to each other. Only like-kind properties may be exchanged. Properties which are NON like-kind may not be exchanged/traded.There are numerous court decisions and IRS rulings which hold that the definition of ‘like-kind’ concerning real property is very broadly defined. Whereas the definition of ‘like-kind’ concerning personal property has been adjudicated by the courts and determined by the IRS as being narrowly defined.Real property such as raw land may be exchanged for an improved property such as a house or apartment building. The form of the taxpayer’s investment property may change, (raw land for improved property), while the substance of the investment may not. The substance of these properties, namely that they all have and will be held/owned by the taxpayer for investment and or for use in a trade or business purpose.But personal property that has been owned by a taxpayer for investment, or for use in a trade or for a business purpose may only be exchanged for essentially the same type of personal property. Therefore a commercial airplane may only be exchanged for a similar type of airplane. An airplane may not be exchanged for a helicopter. A commercial truck may not be exchange for a commercial fishing boat or for real property.It is very important that those taxpayers who may be considering exchanging a personal property asset first determine whether the personal property they want to acquire is a type of property that will satisfy the ‘like-kind’ requirement described above.

WHAT TYPES OF REAL AND OR PERSONAL PROPERTIES ARE CONSIDERED TO BE ‘LIKE-KIND’ FOR PURPOSES OF A TAX DEFERRED EXCHANGE?

There are two elements that both must be satisfied in order for the properties of an exchange to satisfy this basic requirement for a successful exchange. One, the property(is) which are to be disposed, i.e. the ‘relinquished property’ of and the replacement property(is) must have and continue to held/owned for use in a trade, business, or for investment purposes. Examples of properties which would not satisfy this requirement include a primary residence, vacation property, a track of land upon which a developer builds homes for sale, property acquired for the purpose of ‘fixing up’ in order to immediately sold. Two, the relinquished and the replacement properties must be ‘like-kind’ with each other. The following are not eligible to be used in a tax deferred exchange:

- – Inventory or stock in trade

- – Other securities or debt

- – Certificates of trust

- – Primary Residence

- – Indebtedness

- – Stocks, Bonds or Notes

- – Partnership Interests

WHAT IS THE MEANING OF THE TERM ‘BOOT’?

A commonly used term to describe a NON like-kind property or consideration is ‘boot’. The origin of the term ‘boot’ is disputed. One of the versions tells of two ranchers standing at a barbwire fence, (image the Old West); both of them agree to take the others’ land in trade for their ranch. They agree to swap for each others’ land. But there is a problem – one ranch is worth more than the other. To make the deal fair, the Old Timer who owns the less valuable ranch, throws in his ‘boots’, gives his boots to the owner of the more valuable ranch in order to equal the total value exchanged between the two men. Afterwards they ride off into the sunset – music plays and scene fades to the movie credits.

WHAT ARE THE BOOT ‘OFF SET’ RULES’?

A taxpayer who receives ‘boot’ is not necessarily denied the opportunity to use Section 1031. At the beginning of almost all tax deferred exchanges the exchanger/taxpayer receives one or two forms of ‘boot’, that is non like-kind consideration. The two forms of ‘boot’ are #1 cash sale proceeds and #2 debt relief from paying off mortgage. In these instances the taxpayer will need to use the boot off-set rules to be able to conduct a successful tax deferred exchange.

In these circumstances, the disinterested buyer will use cash to acquire the taxpayer’s property. It is important to note that the taxpayer may never actually receive the cash nor be in constructive receipt of cash. One of the Qualified Intermediary’s primary functions during an exchange is to hold these proceeds beyond the control of the taxpayer client.The main question is not if a taxpayer receives any cash or debt relief boot; rather, the question is whether the taxpayer received any net boot once the exchange has been concluded. Did the taxpayer end up with cash in his pocket or did the taxpayer obtain a new loan that was less than the old loan against the relinquished property.

BOOT OFFSET RULES:

1) Cash boot received is offset by cash boot given.

Was all of the sale proceeds remaining after paying usual closing costs and any debt used to acquire one or more replacement properties? If the answer is ‘yes’ then there is no net taxable cash boot.

2) Mortgage boot received is offset by new mortgage boot incurred. If a mortgage was paid off when the relinquished property closed then was new debt incurred of equal or greater amount to acquire the replacement property(ies)? If ‘yes’ then there will be no net mortgage boot. There is an exception to the mortgage boot rule. If a taxpayer used the proceeds from the relinquished property to pay off an existing loan, the exchanger/taxpayer is not required to incur new debt. A taxpayer is always permitted to use ‘other cash’ such as funds from a separate bank account, instead of getting a new loan to acquire the replacement property.

Example: Taxpayer A sells Whiteacre for $100,000 as part of a Section 1031 exchange. A mortgage of $100,000 was paid off during closing. Rather than getting a new loan for $100,000, Taxpayer A may choose to use $100,000 from a savings account to acquire the exchange replacement property Blackacre. There will be no net mortgage boot.

So long as the values of the replacement property(ies) are of equal or greater value to total value of all of the relinquished property(ies), all of the net cash boot was used to acquire these properties, and if any relinquished property(ies) loans were paid off have been replaced by a new loan and/or by the use of ‘other cash’, then there will not be any taxable boot to worry about.

ARE THERE TYPES OF ASSETS WHICH SIMPLY MAY NOT BE PART OF A TAX DEFERRED EXCHANGE?

Yes, the IRS has specifically declared the following assets do not qualify for Section 1031 treatment:

– Inventory or stock in trade

– Stocks, bonds, or notes

– Other securities or debt

– Partnership interests

– Certificates of trust

WHAT IS A QUALIFIED INTERMEDIARY/FACILITATOR?

The role of a Qualified Intermediary is defined in Treas. Reg. Section1.1031 (k)-1(g) (4). Other commonly used names for this position include ‘Facilitator’ and ‘Accommodator’. A Qualified Intermediary is not the taxpayer or a disqualified person (as defined in paragraph (13) of this section).A qualified intermediary is a person or business entity who enters into a written agreement with the taxpayer, (the “exchange agreement”), and as required by the exchange agreement, acquires the relinquished property from the taxpayer, transfers the relinquished property to a third party buyer, acquires the replacement property from a third party seller, and transfers the replacement property to the taxpayer. The QI holds the proceeds from the sale of the relinquished property in a trust or escrow account in order to ensure the Taxpayer never has actual or constructive receipt of the sale proceeds. These proceeds are used to acquire one or more replacement properties.

WHAT IS A ‘DISQUALIFIED INTERMEDIARY?

A ‘disqualified intermediary’ is a person or business entity that is the agent of the taxpayer at the time of the transaction. For this purpose, a person who has acted as the taxpayer’s employee, attorney, accountant, investment banker or broker, or real estate agent or broker within the 2-year period ending on the date of the transfer of the first of the relinquished properties is treated as an agent of the taxpayer at the time of the transaction.

There are exceptions to the scope of what constitutes a ‘disqualified intermediary; they are:

– Services for the taxpayer with respect to exchanges of property intended to qualify for nonrecognition of gain or loss under section 1031; and

– Routine financial, title insurance, escrow, or trust services for the taxpayer by a financial institution, title insurance company, or escrow company.

PLEASE ADD US TO YOUR FAVORITES so that you may continue to check back for additional content.